Casual Award Rates Victoria

The rates in this guide apply from 29 may 2020.

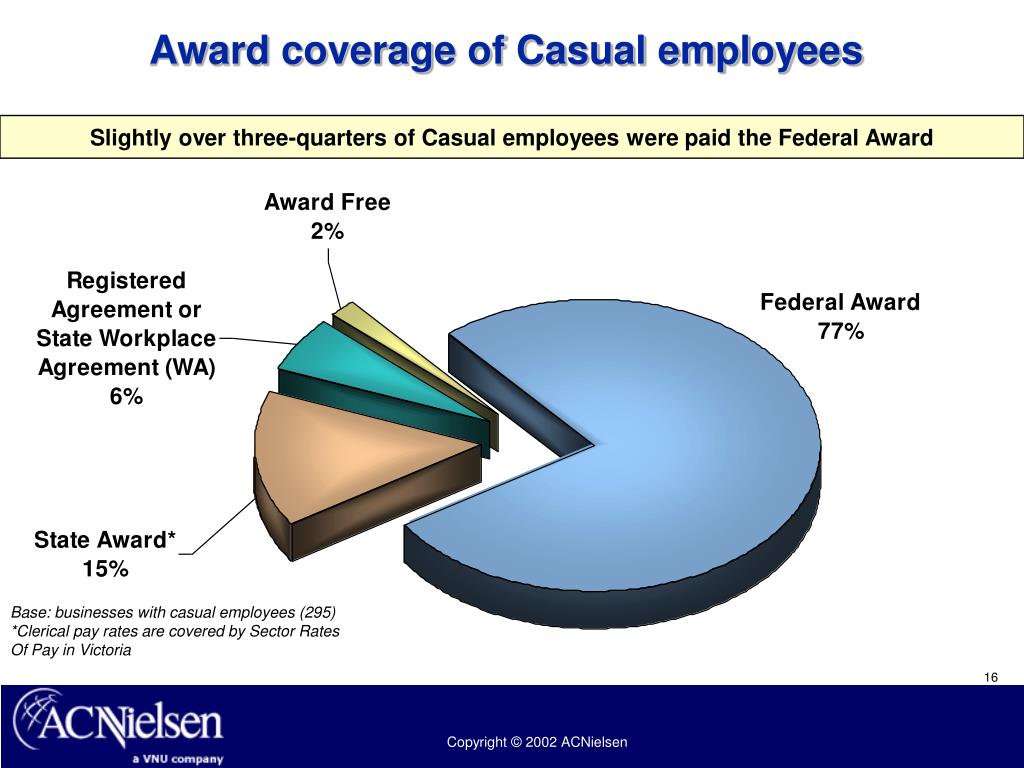

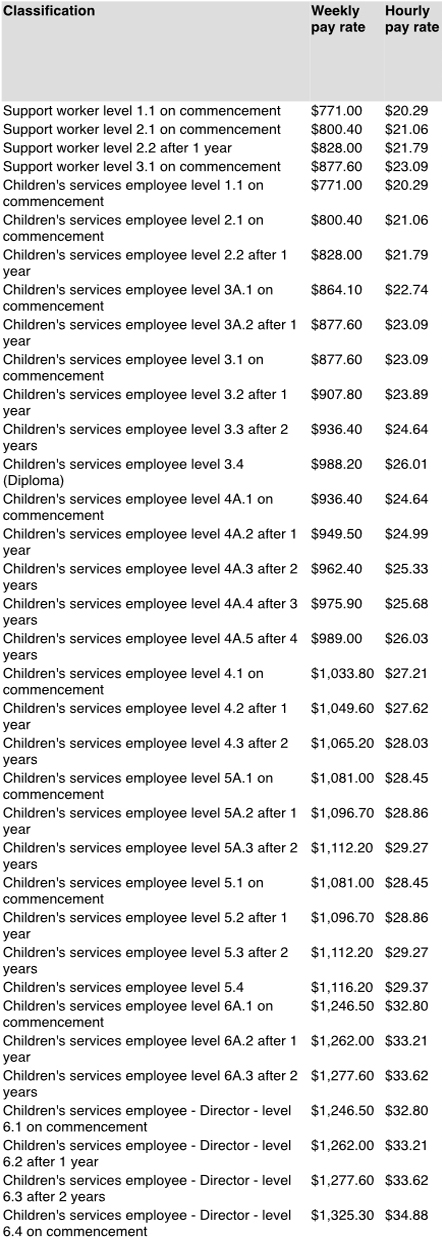

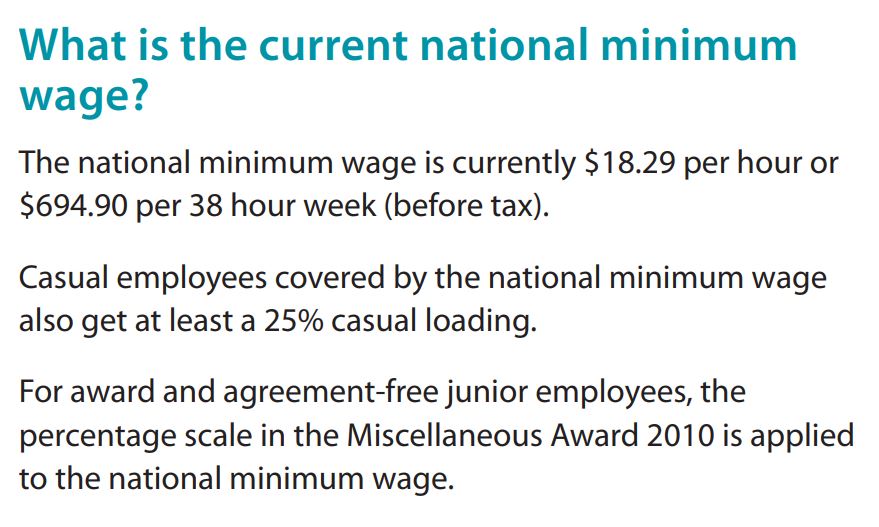

Casual award rates victoria. The pay calculator calculates base pay rates allowances and penalty rates including overtime. Residential and support services victoria award 1999 ap795711 pay guide docx 1586kb pdf 1mb social and community services victoria award 2000 ap796561 pay guide docx 1563kb pdf 16mb social and community services act award 2001 ap808334 pay guide docx 1286kb pdf 5633kb. Most awards have a minimum process for changing casual employees to full time or part time. For example if a casual employee is paid the current national minimum wage of 1949 per hour and their award or agreement stipulated a.

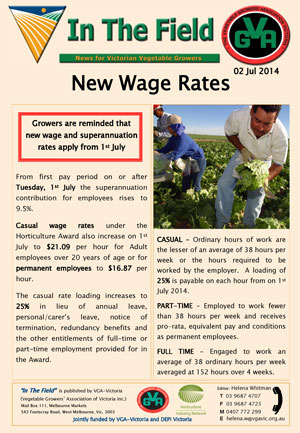

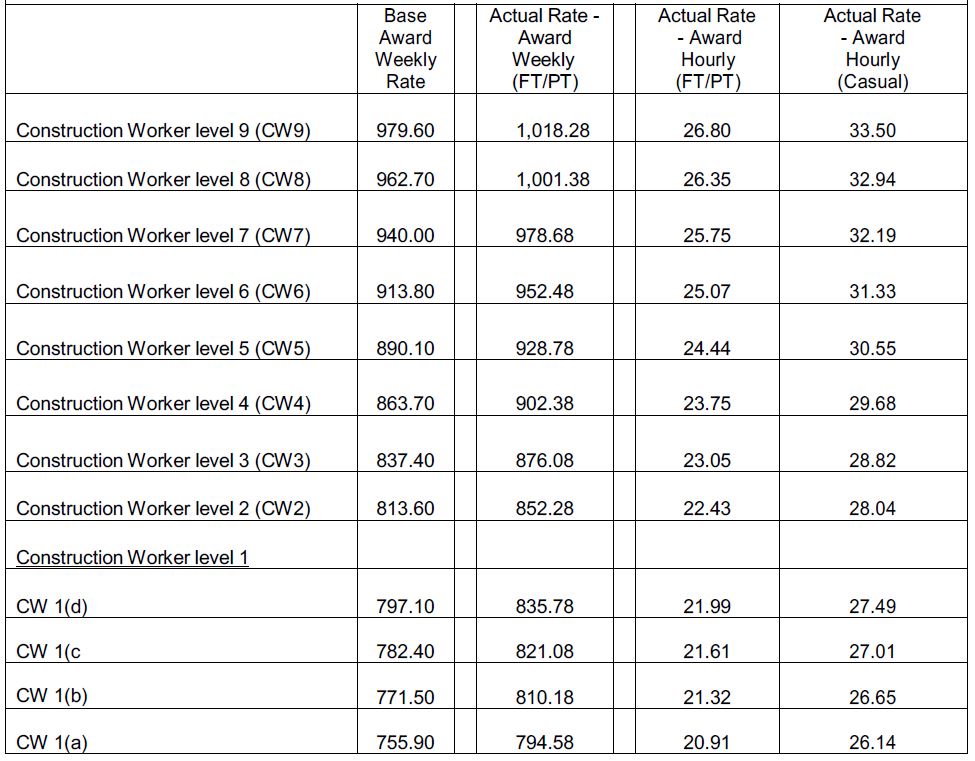

Casual and part time loadings. The pay guides have the current minimum pay rates for full time part time and casual employees in an award. Browse the full list of pay guides to access the one that applies to you. The transitional provisions apply to.

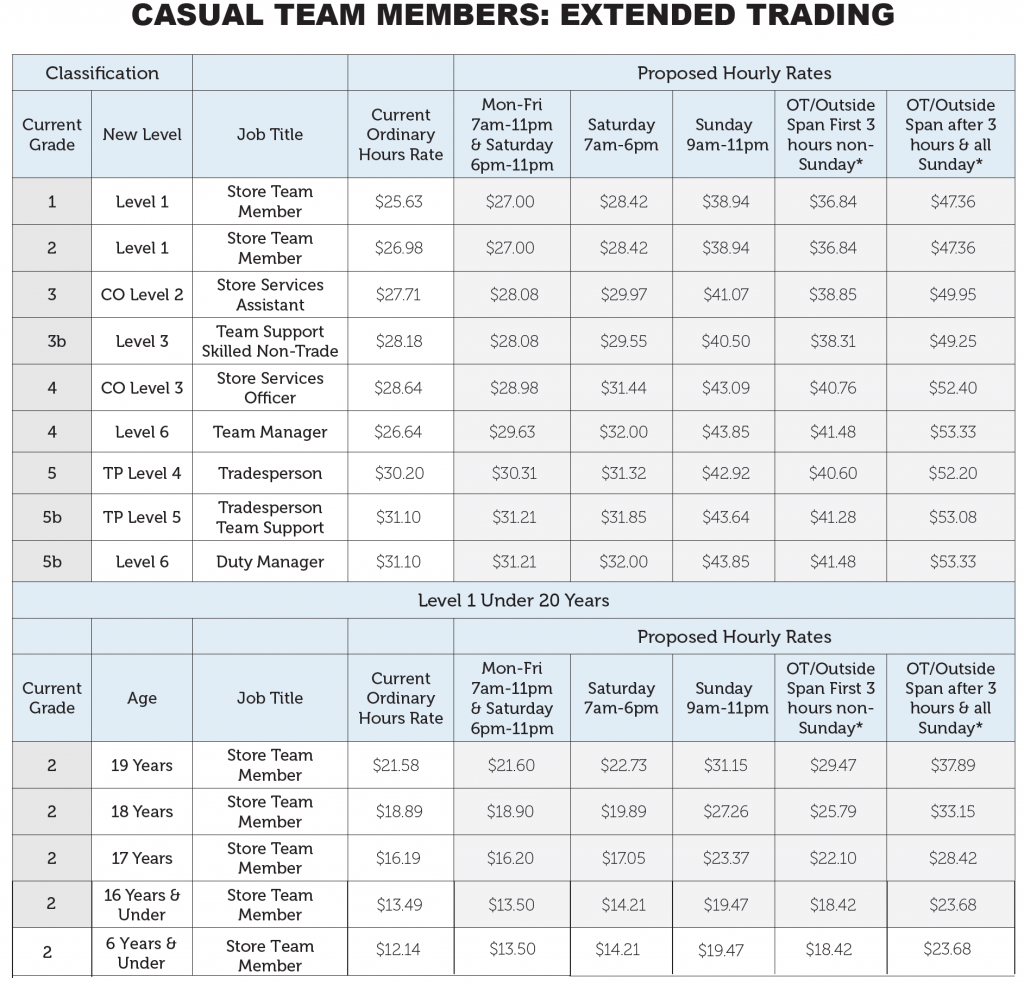

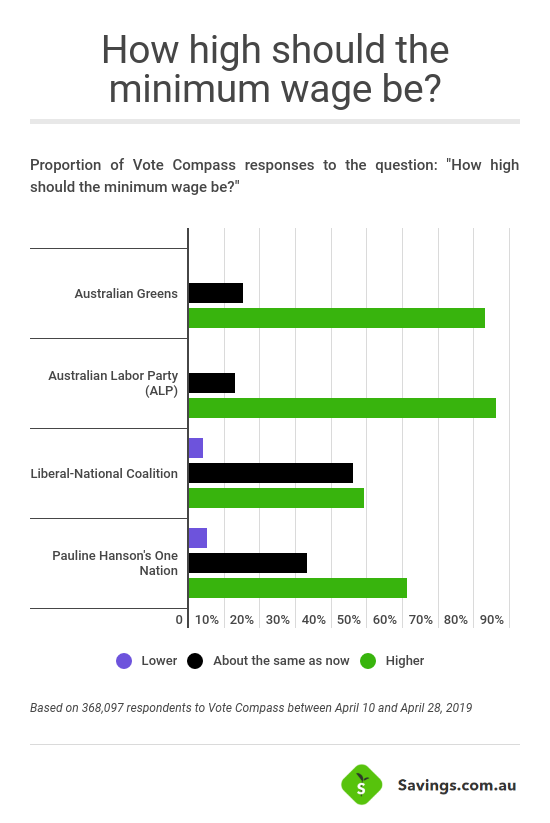

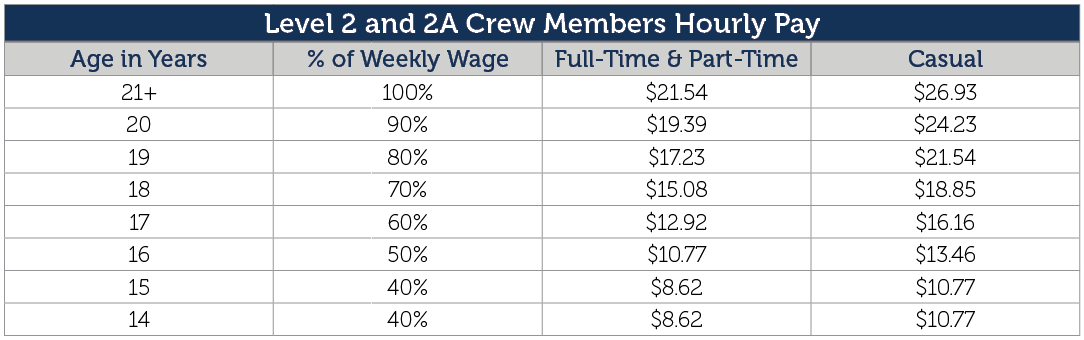

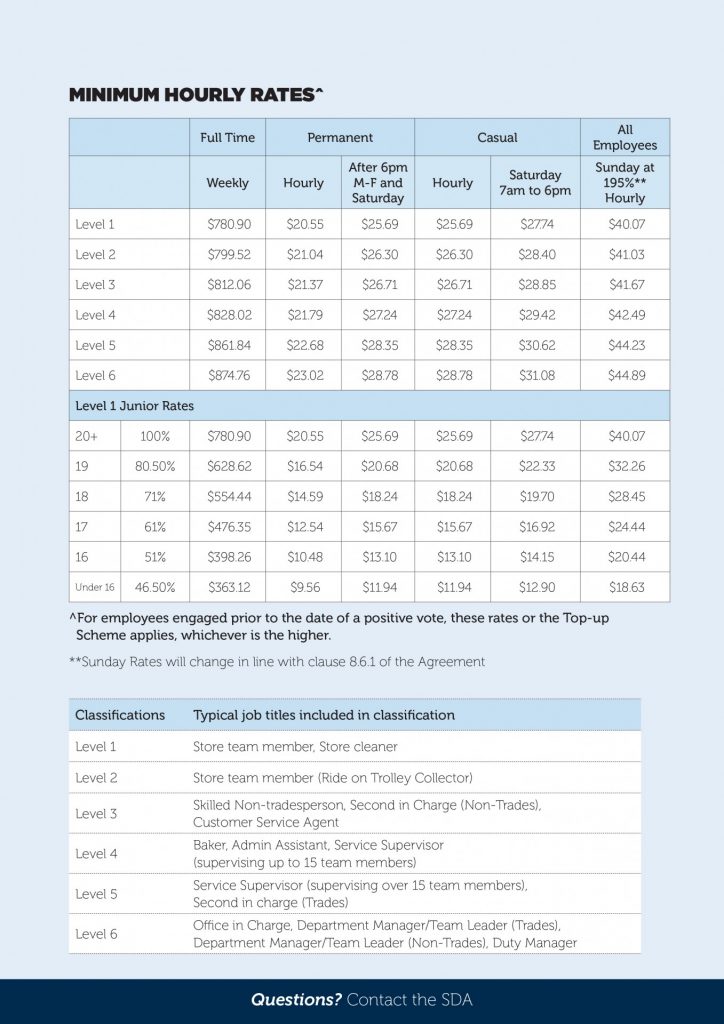

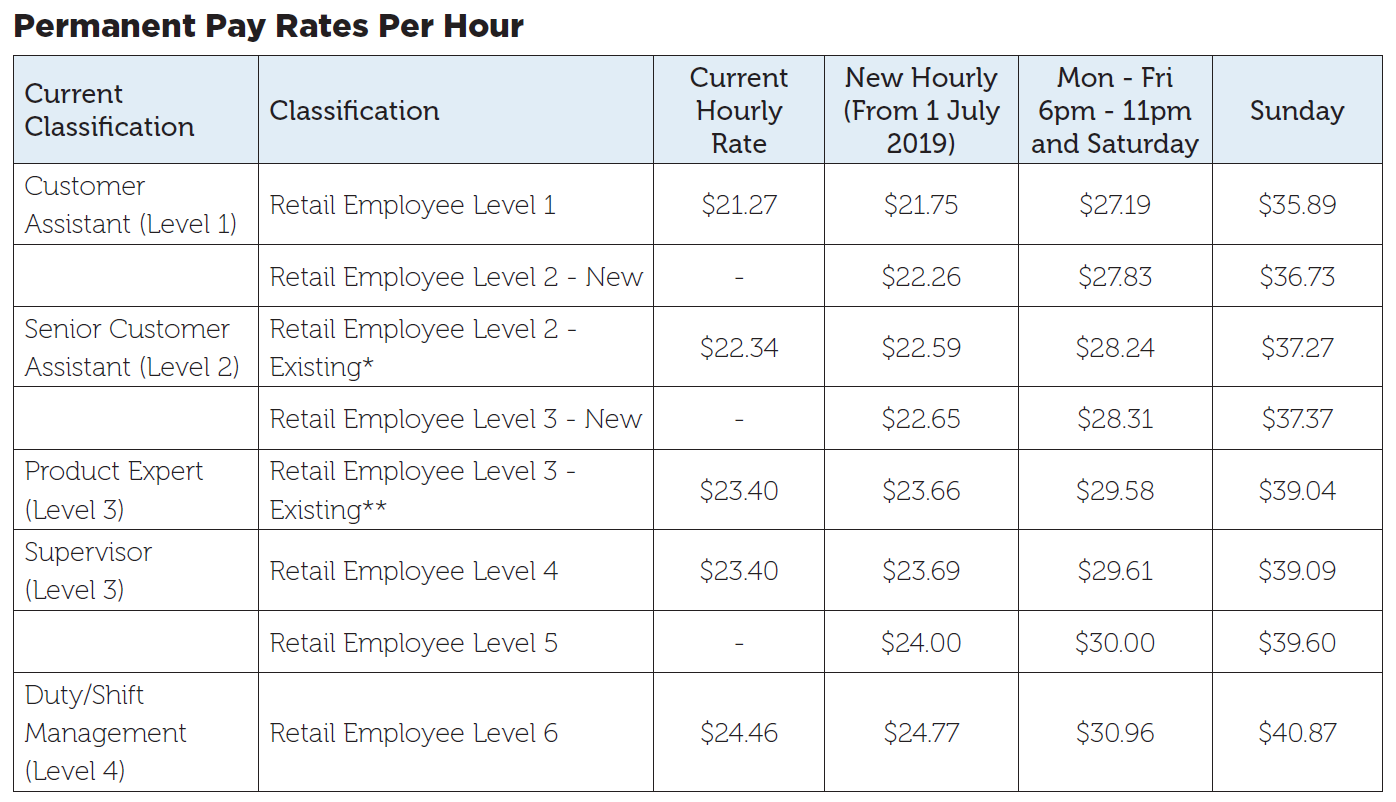

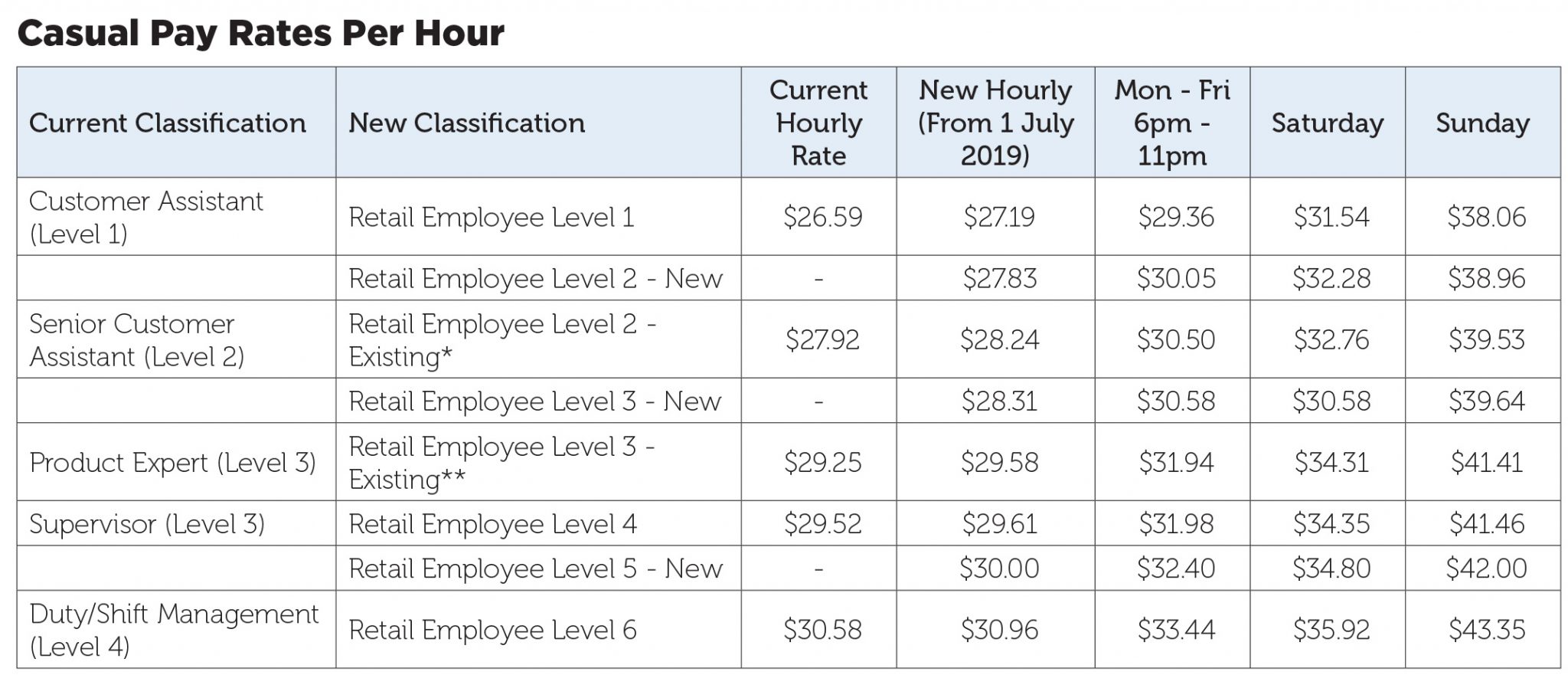

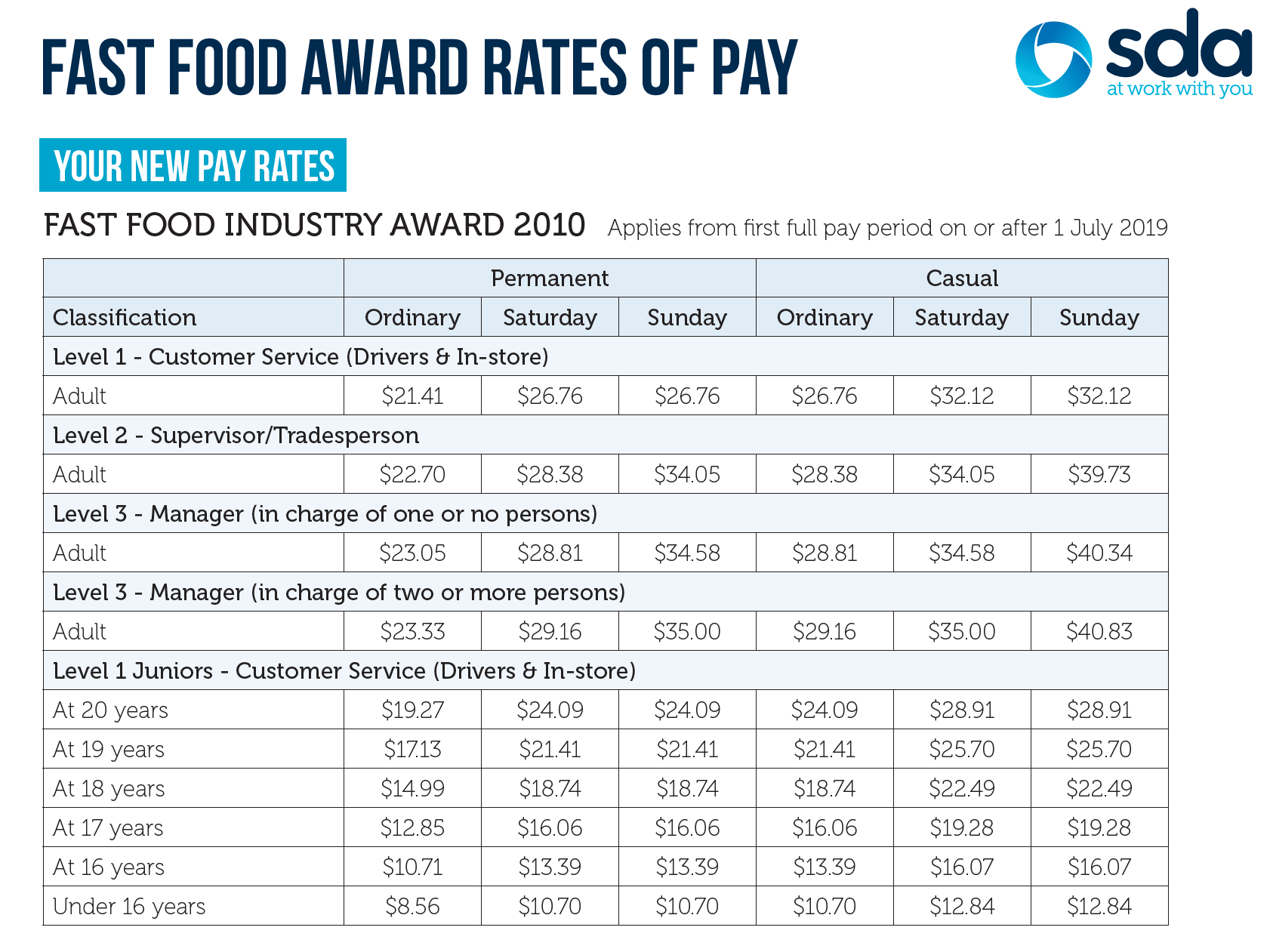

These rates are for workers covered by the general retail industry award onlycheck to see if youre covered by an enterprise bargaining agreement eba negotiated by your union here. To calculate the casual loading rate you must multiply an employees permanent hourly rate by the percentage of the casual loading rate as stated in the relevant modern award or enterprise agreement. While modern awards contain minimum wages some modern awards have transitional arrangements in place whereby the wage related components that came into effect 1 july 2010 may be phased in over five years. There are new versions of awards being released throughout 2020.

Subscribe to email updates and well let you know when the new minimum pay rates for the other awards are available in our pay tools. Pact pay calculator find your award skip to main content. Casual relief teachers hourly and maximum daily rates effective from. Information about the definition and operation of allowances penalties and overtime can be found in the award and the pay and conditions tool.

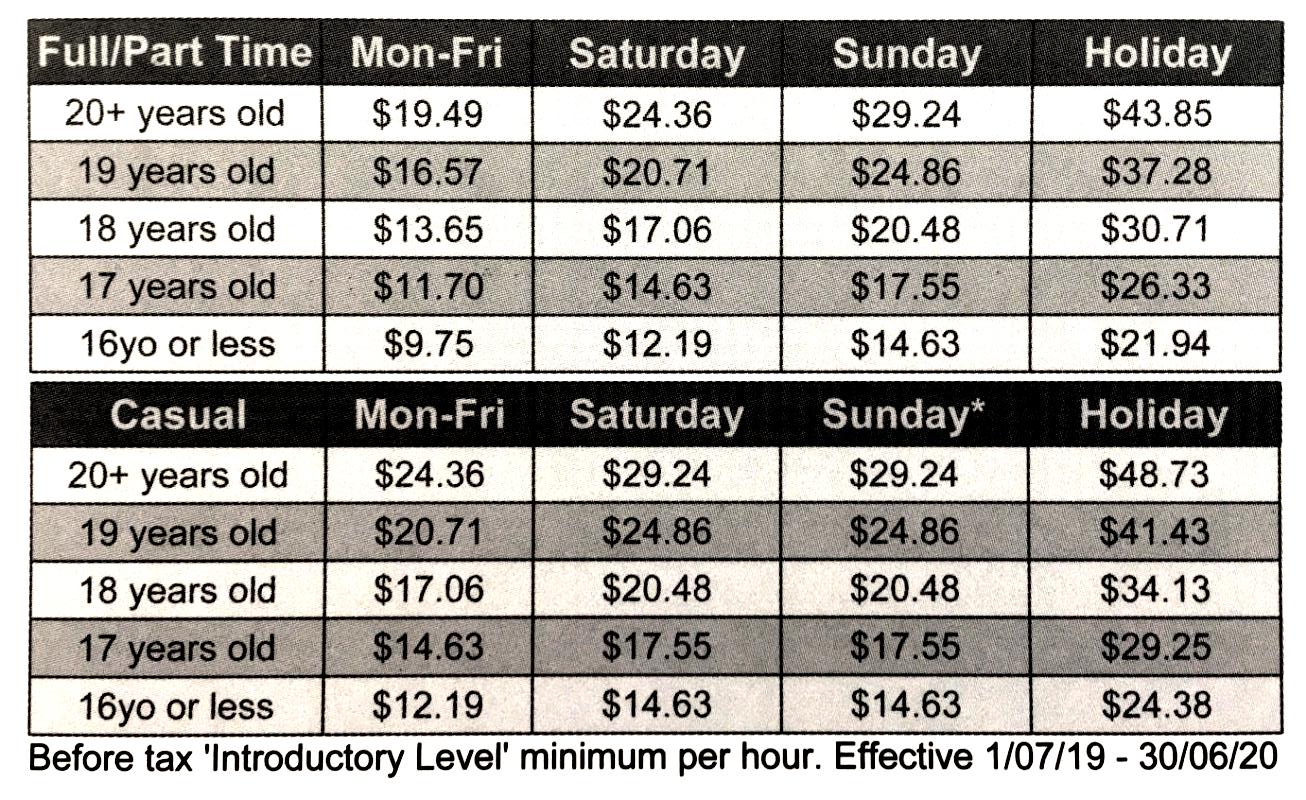

Some enterprise agreements and other registered agreements have a similar process. Select from the drop down options below to calculate your base pay rate and weekend penalty rates you are entitled to under the general retail industry award from 1 july 2020. 1072017 1042018 1102018 1042019 1102019 1042020 1102020 hourly rate 5797 5884 5987 6077 6183 6276 6386 maximum daily rate 34781 35303 35921 36460 37098 37654 38313. Pay guide hospitality industry general award ma000009 published 26 june 2020 pay rates for this award will change from 01 february 2021.

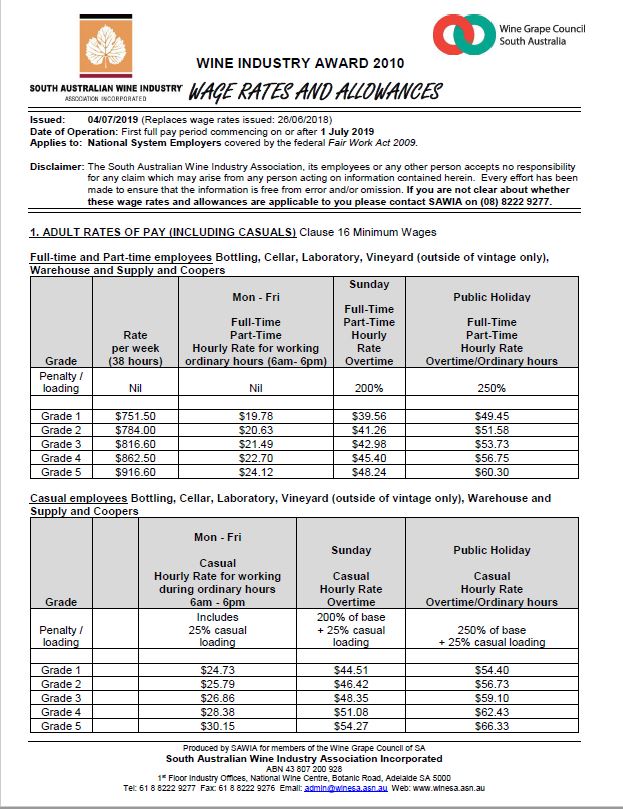

Base rates of pay including piecework rates. How much should you be getting paid. They apply from 1 july 2019. You can find the new rates for the first group of awards in our pay and conditions tool and pay guides.

:max_bytes(150000):strip_icc()/toppayingstates-waitersbartenders2-df47357e679348268915cdcc83351fd9.png)

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/HSKPGHQGKRCMTN3ROILOCJVMQM.jpg)

.webp)