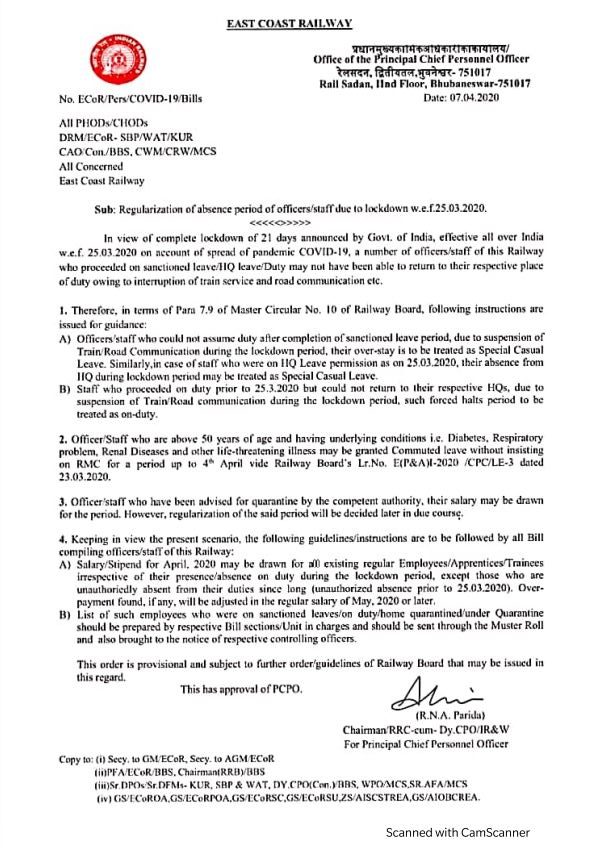

Regularization Of Casual Labour In Income Tax Department 2018

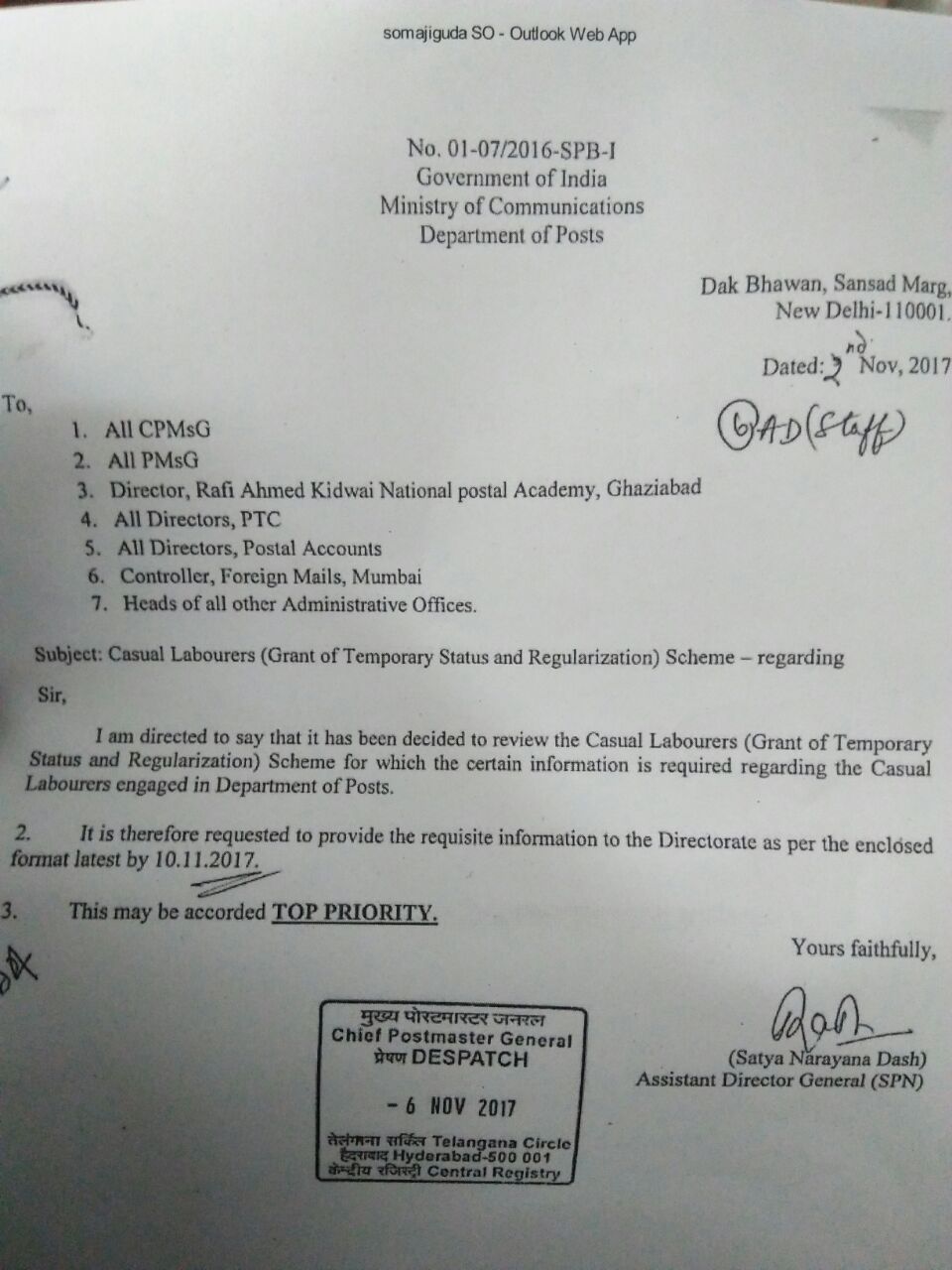

The undersigned is directed to say that casual labourers grant of temporary status regularisation scheme of government of india 1993 circulated vide dopt om no.

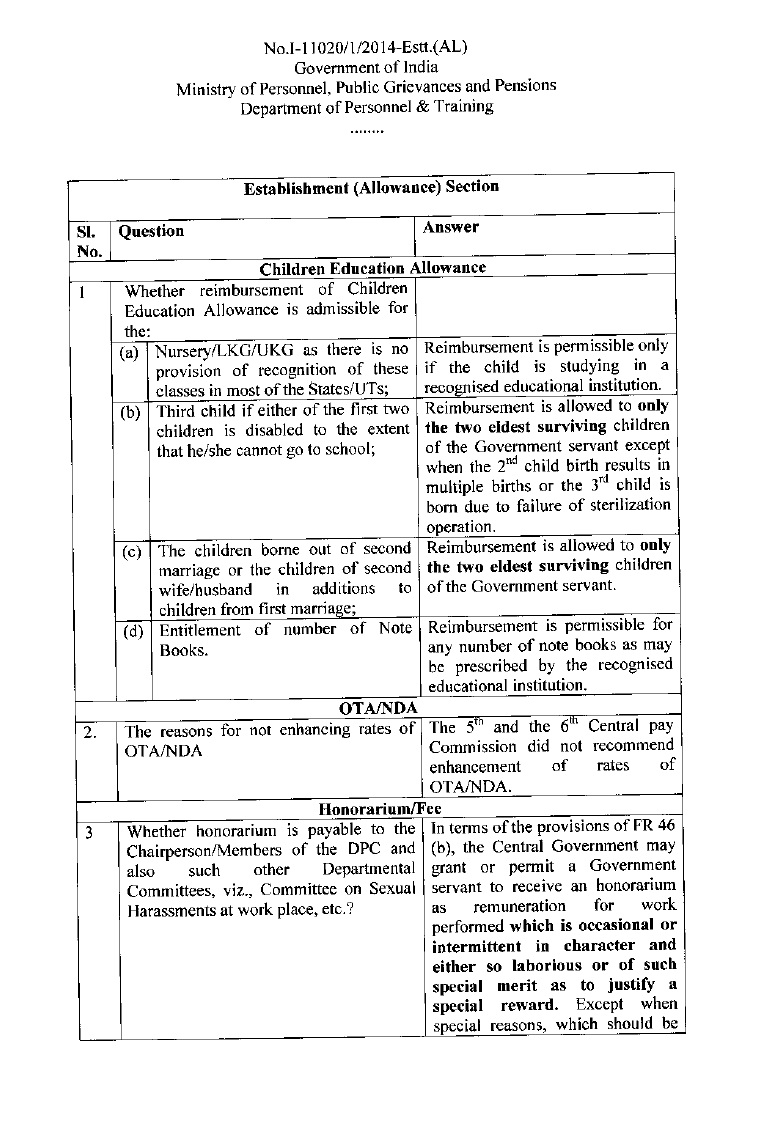

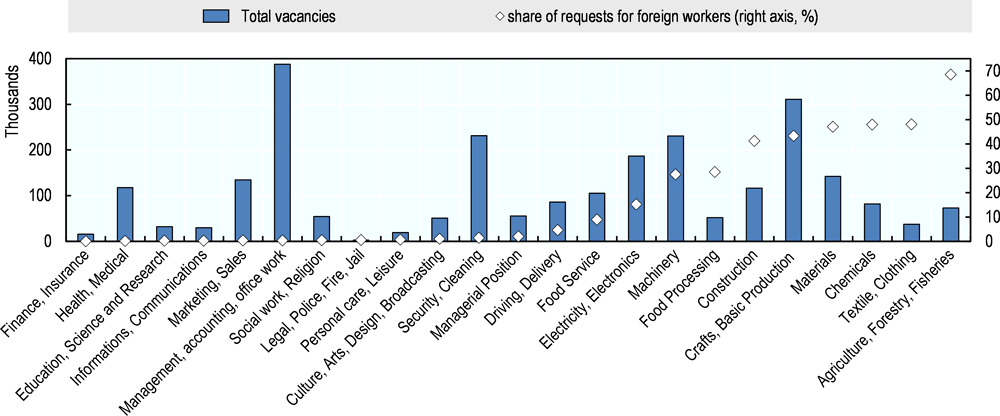

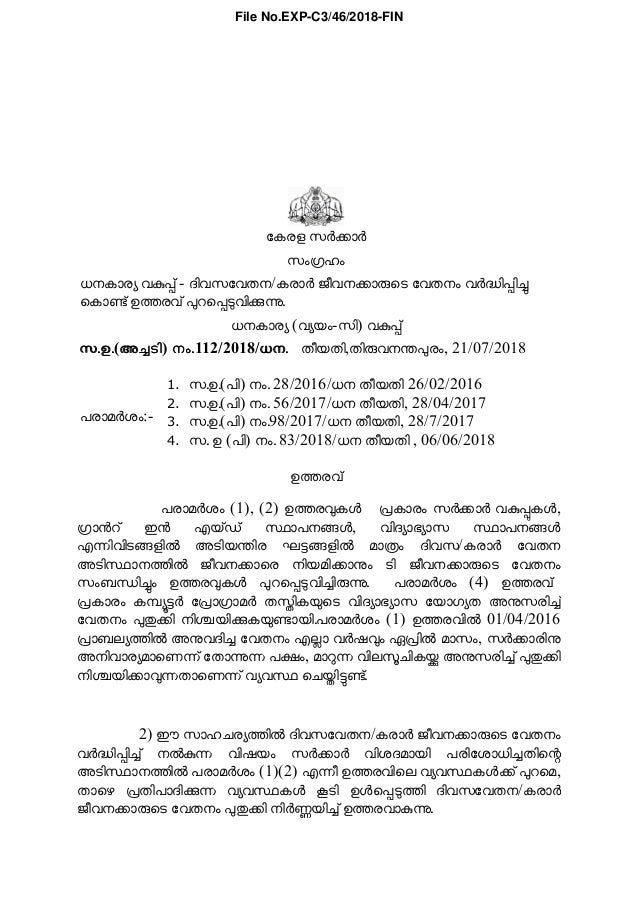

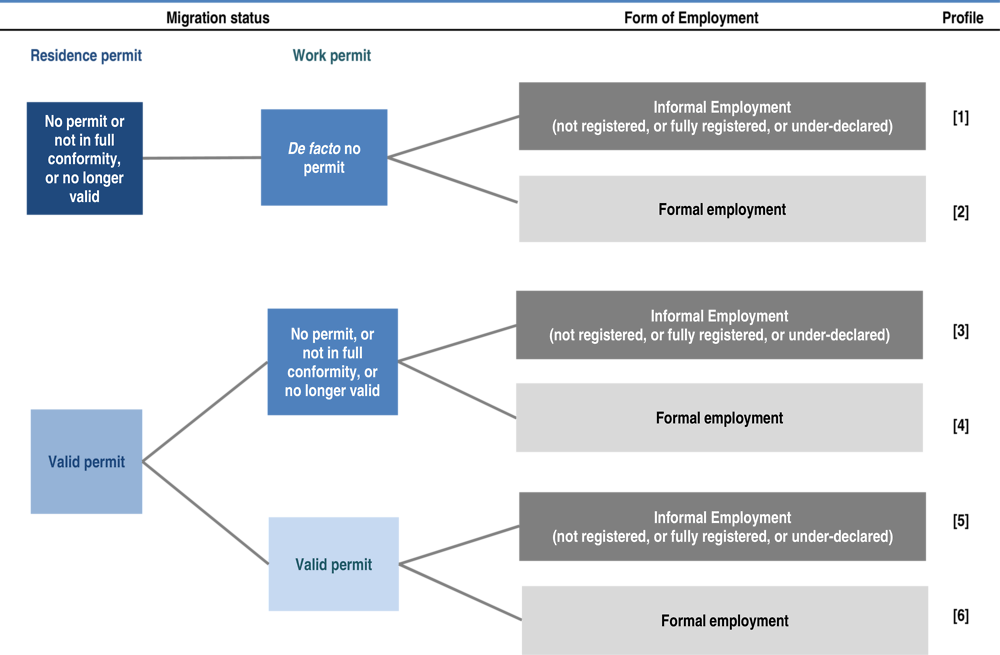

Regularization of casual labour in income tax department 2018. Social security and welfare and 4. 30 chapter iv charge of income tax 16. Ii section page 16c. 9regularization of casual labour with temporary status cl ts proposals from ministriesdepartments on regarding.

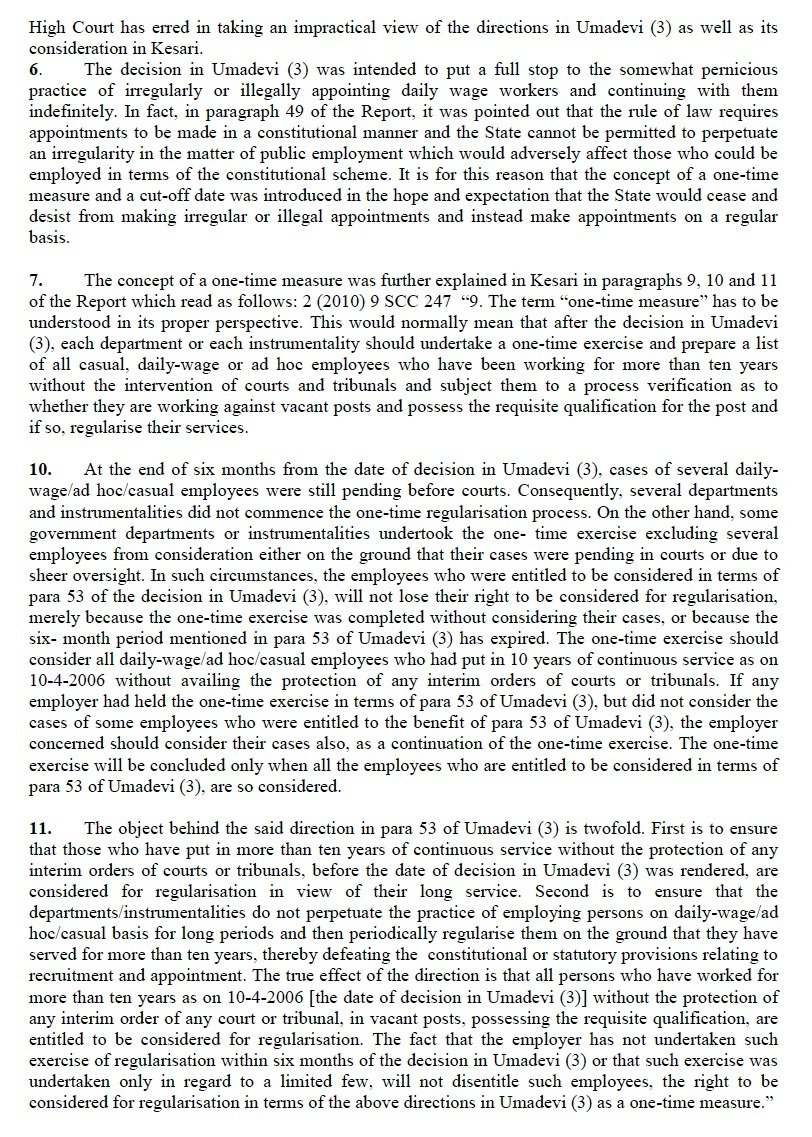

M b lokur reportable in the supreme court of india civil appellate jurisdiction ci. Charge of additional tax. Raised the issue in parliaments zero hour discussion regarding regularization of casual labour daily wages employees working in income tax department mumbai. Achievements made in labour welfare in 2018 labour codes proposal was made.

Charge of excess profit tax. Charge of income tax. Regularization of casual labour with temporary statuscl ts proposals from ministriesdepartments on regarding. The sint maarten tax administration will implement the laws and regulations for the levying collection and auditing of taxes with the aim of attaining stable and growing tax revenues in an extremely efficient effective customer oriented and honest manner.

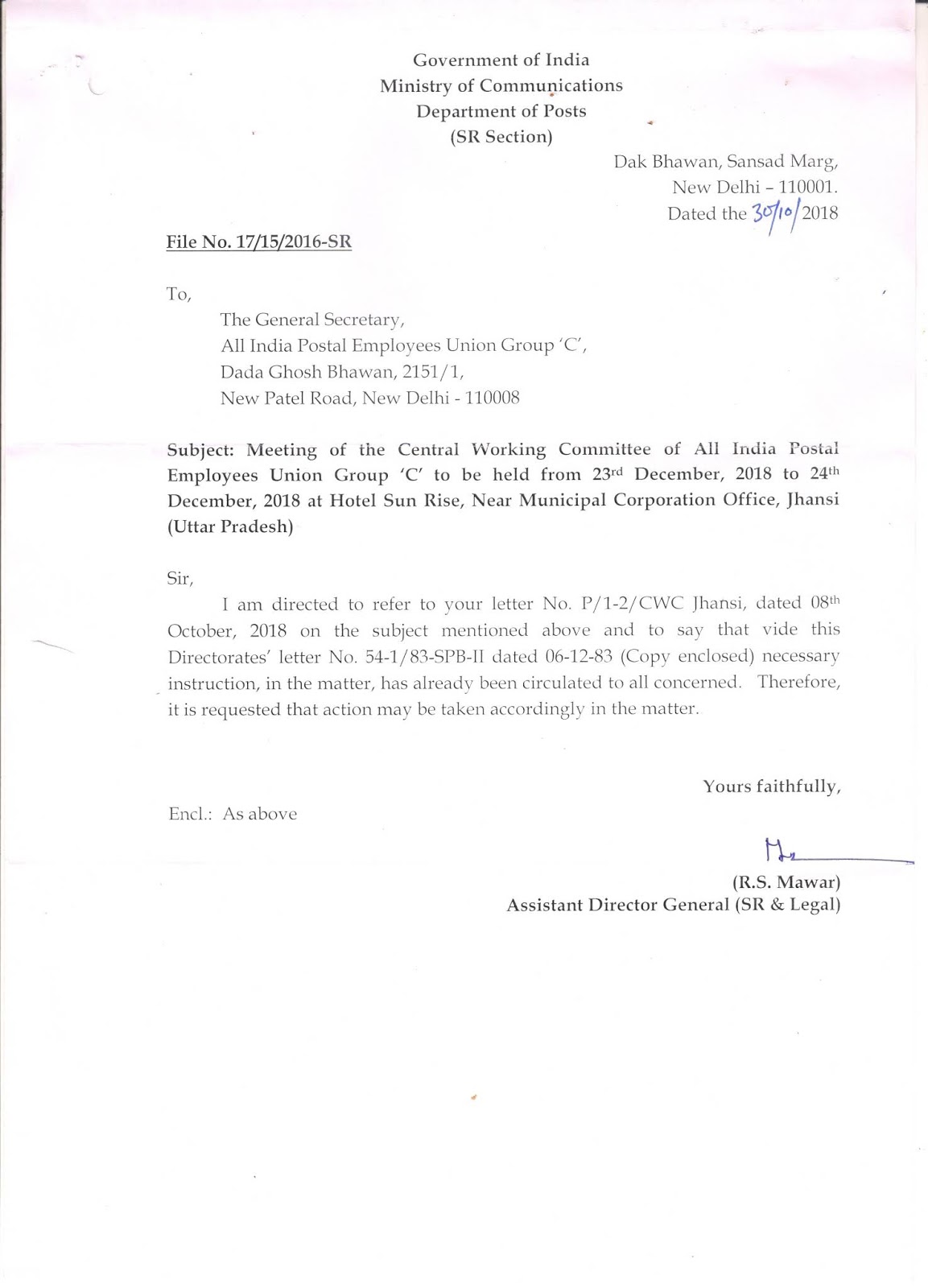

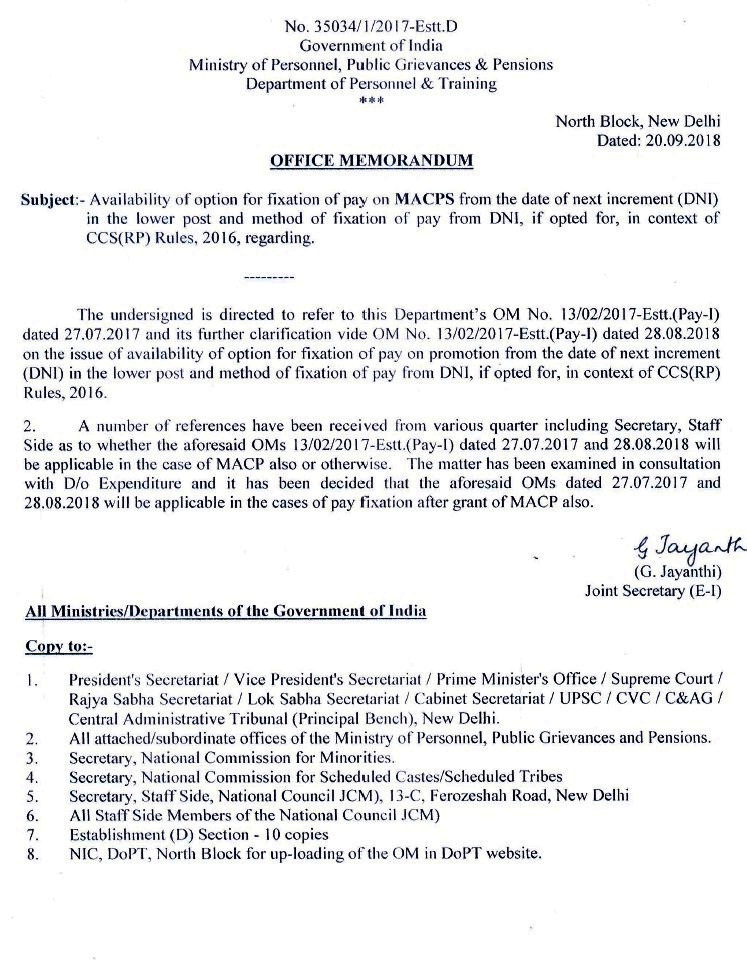

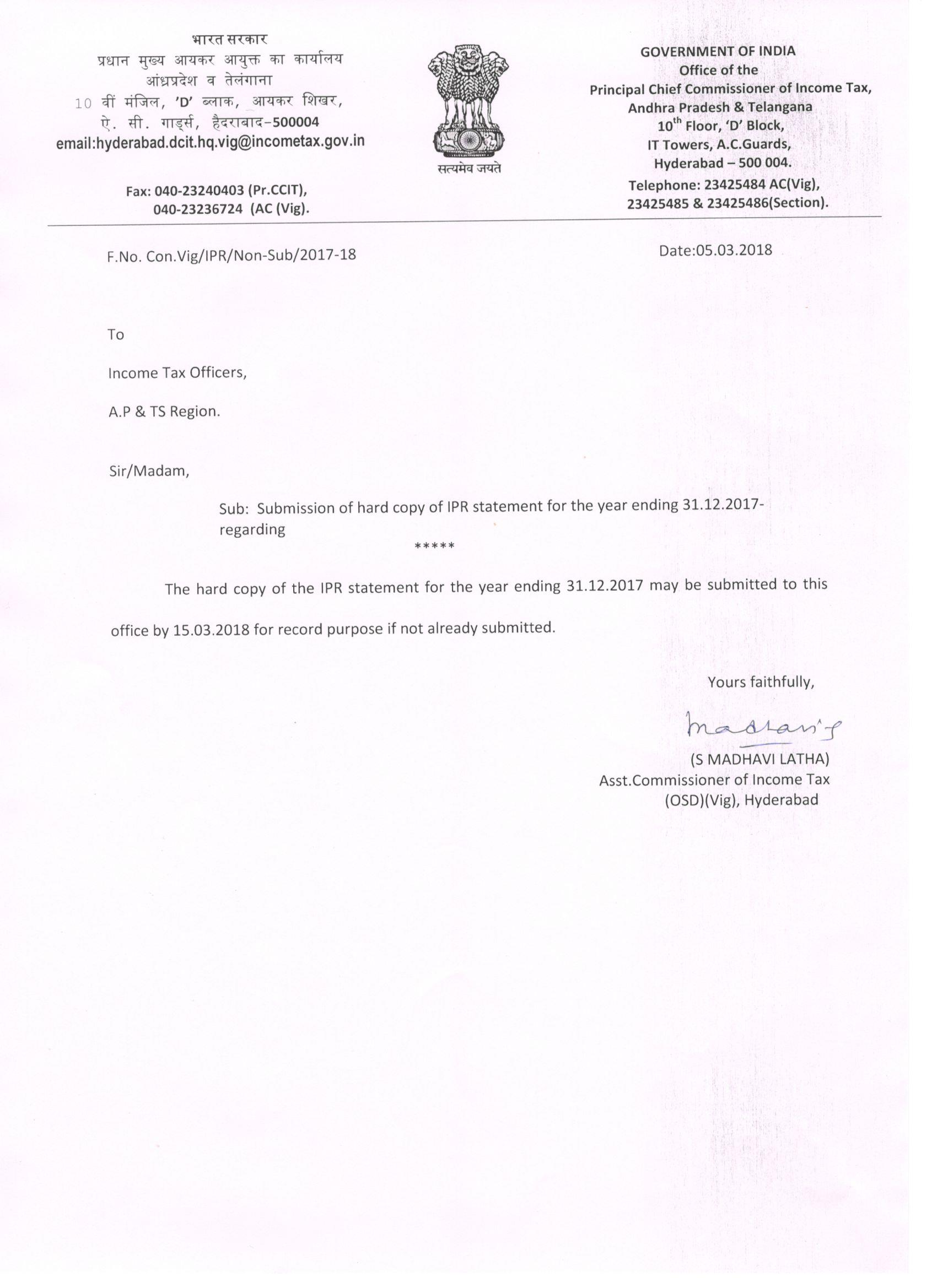

51016290 esttc dated 10091993 stipulated conditions for grant of temporary status and regularization of services to the persons recruited on daily wage basis in the central government offices as on 10091993. Based on the recommendation of the second national labour commission the ministry of labour and employment has taken steps to form 4 labour codes by simplifying existing labour laws here are the codes 1. 8gpf and pension benefits to casual labour with temporary status regularised after 112004 regarding. Fno4901432014 esttc government of india ministry of personnel public grievances pensions department of personnel training.

Charge of minimum tax. North block dated 16th october2014. 49011312008 esnc dated 17th february2009 had requested all ministries department to provide information relating to cl ts on their rolls.